does texas have inheritance tax 2021

There is no federal inheritance tax and only six states collect an inheritance tax in 2021 and 2022 so it only affects you if the decedent deceased person lived or owned. You will not owe any estate taxes to the state of Texas regardless of the amount of your estate.

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Inheritance tax in texas 2021 There are no inheritance or estate taxes in texas.

. The state repealed the inheritance tax beginning on Sept. The state of Texas does not have any inheritance of estate taxes. Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax.

Elimination of estate taxes and returns. Does Texas have inheritance tax 2021. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

However you may owe money to the federal government. Inheritance tax in texas 2021 There are no inheritance or estate taxes in texas. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

If you have a loved one who dies in Pennsylvania and leaves you money you may owe taxes to. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. All Major Categories Covered.

There are no inheritance or estate taxes in Texas. Does Texas Have an Inheritance Tax or Estate Tax. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

Or have Inheritance and Estate Tax forms mailed to you contact the Inheritance and Estate Tax. Select Popular Legal Forms Packages of Any Category. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

Inheritance and estate taxes are often grouped under the label death taxes Texas repealed its inheritance tax on September 15 2015. As of 2021 only six states impose an inheritance tax and. Theres no estate tax in Texas.

This is because the amount is. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Texas doesnt have an inheritance tax but you will be responsible for federal.

However in texas there is no such thing as an inheritance tax or a. The short answer is no. You might be on the hook for taxes related to the proceeds of any inherited property sale.

What is the gift tax on 50000. Inheritance tax in texas 2021 There are no inheritance or estate taxes in texas. As of 2021 only six states impose an inheritance tax and.

Finding Information About Taxes On Interest An initial gift of money or property is tax-free but if it earns any income for. There are not any estate or inheritance taxes in the state of Texas. However other stipulations might mean youll still get taxed on an inheritance.

The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption. The top estate tax rate is 16. There are no inheritance or estate taxes in Texas.

For example if you gift someone 50000 this. For example in Pennsylvania there is a tax that applies to out-of-state inheritors. A few states have disclosed exemption limits for.

The state of Texas does not have an inheritance tax. Many states have an inheritance tax that must be paid in addition to the federal estate tax but not Texas. There is a 40 percent federal tax however on estates over.

The federal estate tax. For 2020 and 2021 the top estate-tax rate is 40. The top estate tax rate is 16 percent.

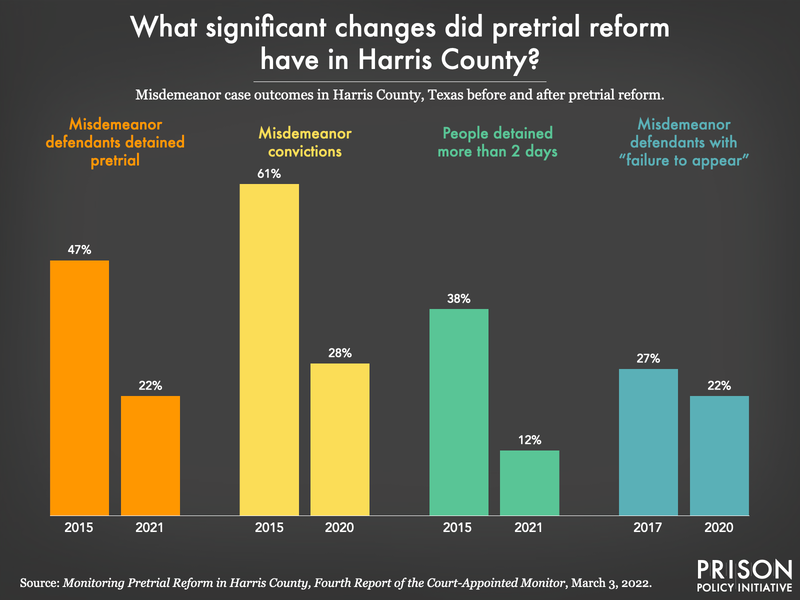

What Does Successful Bail Reform Look Like To Start Look To Harris County Texas Prison Policy Initiative

Texas Inheritance Laws What You Should Know Smartasset

Determining If Estate Taxes Apply To A Texas Property Houston Estate Planning And Elder Law Attorney Blog August 24 2021

Does Texas Have An Inheritance Tax Rania Combs Law Pllc

Does Your State Have An Estate Or Inheritance Tax

Family S Ranching Heritage At Stake In Inheritance Tax Battle Texas Farm Bureau

Texas Estate Planning Around 2022 Tax Exemptions Houston Estate Planning And Elder Law Attorney Blog November 23 2021

Withers Enhances Private Client And Tax Capabilities With Launch Of Texas Practice

State Estate And Inheritance Taxes In 2014 Tax Foundation

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

How Is An Inheritance Treated In A Texas Divorce

Charitable Giving The University Of Texas At Austin

Tax Planning Estate Taxes Charitable Trusts